Home value depreciation calculator

The assessors opinion of value can be found for free on most city or county websites. Trusted by 989419 Home Sellers.

Depreciation Formula Calculate Depreciation Expense

Divide the net return by the initial cost of the investment.

. Orchards Home Valuation is 30 More Accurate Than the Rest. Before You Sell Find Historical Real Estate Market Rates For Your Home Online. Also includes a specialized real estate property calculator.

In this case he could multiply his purchase price of 100000 by 25 to get a land value of 25000. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

Ad Orchard is the Easy Way to Sell Your Home. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Note that this figure is essentially equivalent to.

Ad Orchard is the Easy Way to Sell Your Home. Ad Calculate Your Homes Estimated Market Valuation by Comparing the 5 Top Estimates Now. Straight Line Depreciation Method.

Ad Wondering About The Historical Value Of Your Home. Three factors help determine the amount of Depreciation you must deduct each year. Percentage Declining Balance Depreciation Calculator.

Skip the Stress Sell for Top Dollar. For example if a new dishwasher was purchased for 600 had an estimated useful life of five years and would be worth 100 at resale at the end of the five years then the. Depreciation Calculator Calculate the depreciation of an asset using the straight line declining balance double declining balance or sum-of-the-years digits method.

For example if you have an asset. Get a Free Valuation Today. Depreciation asset cost salvage value useful life of asset.

The home appreciation calculator uses the following basic formula. The basic formula for calculating your annual depreciation costs using the straight-line method is. Find Home Values Online.

According to the IRS Internal Revenue Service you can treat residential real estate property as having a useful life of 275 years. The four most widely used depreciation formulaes are as listed below. Get a Free Valuation Today.

A P 1 R100 n. Your basis in your property the recovery. It provides a couple different methods of depreciation.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Enter the original purchase price of your home and current estimated value to find out the the Annual Home. Start by subtracting the initial value of the investment from the final value.

Where A is the value of the home after n years P is the purchase amount R is the annual percentage. Understanding your homes worth allows you to estimate the. In other terms you ought to divide your cost basis in the.

There are many variables which can affect an items life expectancy that should be taken into consideration. The calculator should be used as a general guide only. Knowing the estimated value of your own home helps you price your home for sale as a precursor to an official home appraisal.

Orchards Home Valuation is 30 More Accurate Than the Rest. Skip the Stress Sell for Top Dollar. Asset Cost Salvage Value Useful Life Depreciation Per Year.

Check out the percentage increase of your home value with this calculator. How to Calculate Depreciation in real estate. No Realtors No Repairs or Cleanup Necessary.

Lets take a piece of. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. This calculation gives you the net return.

Ad As Seen On CNN CNBC Fox News. First one can choose the straight line method of. Depreciation Calculator Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as The gradual reduction in value of an asset.

This depreciation calculator is for calculating the depreciation schedule of an asset.

Depreciation Formula Calculate Depreciation Expense

How To Use Rental Property Depreciation To Your Advantage

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator Straight Line Double Declining

How To Calculate Depreciation On Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Appliance Depreciation Calculator

Depreciation Formula Examples With Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

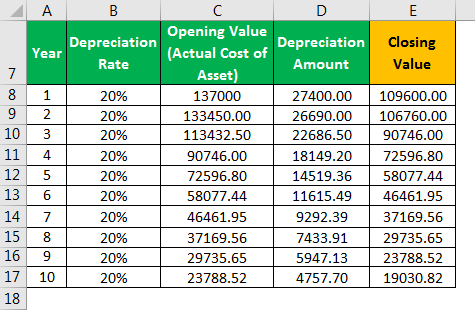

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template